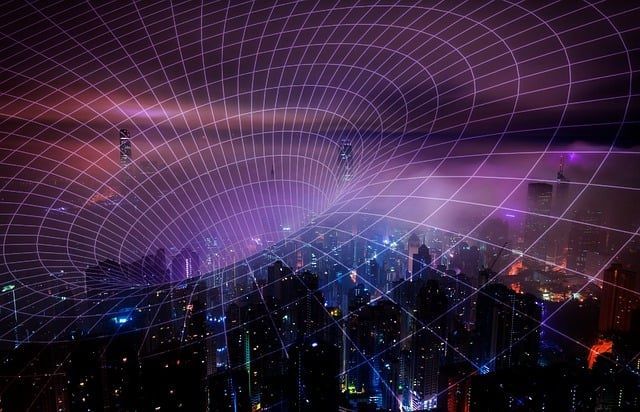

Mexican 5G Dash: Boosting Connections & Revenues to the Next Level

Discover how the faster rollout of 5G networks in Mexico is set to revolutionize the internet access market with a predicted 4% annual growth from 2023 to 2026. Learn about the impact on industries and the potential growth of technologies like AI and the metaverse.

Mexico is poised for a technological leap with the rollout of 5G networks, which will bring faster internet speeds and better connectivity to the country. The market for internet access is expected to grow by 4% annually from 2023 to 2026, with a focus on reaching previously unconnected populations and areas.

With the increasing demand for mobile connectivity, hybrid work, and distance education, 5G technology will drive the growth of mobile services and video consumption, accounting for up to 80% of all data usage.

The use of innovative technologies like AI, AR, and digital twins is also expected to surge, boosting the competitiveness of Mexico in the Latin American region. Get ready for Mexico's 5G sprint toward a connected future.