Amazon responds about its Tijuana center

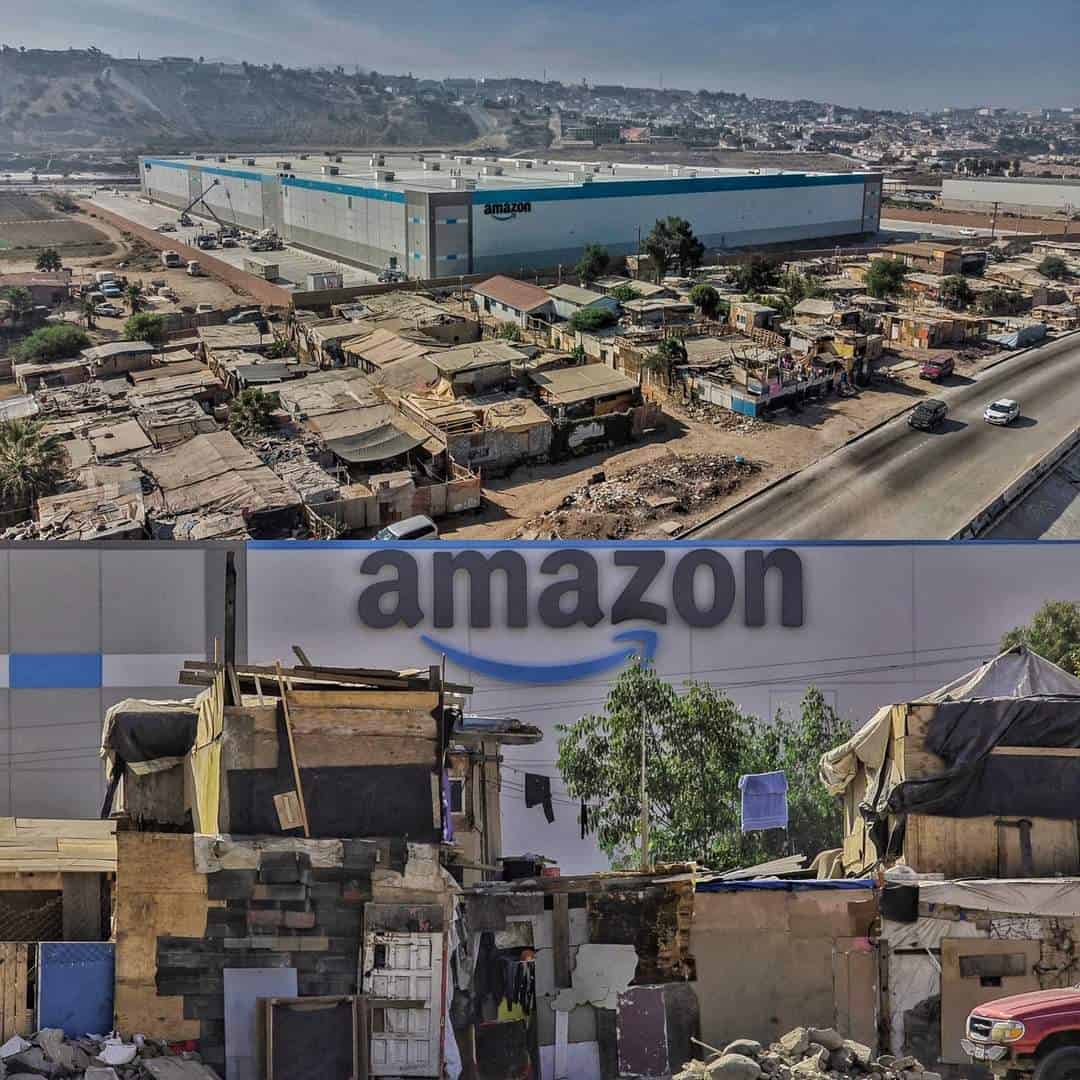

Images of Amazon's new plant in Tijuana went viral, contrasting with the surrounding housing in one of the poorest neighborhoods.

After images of Amazon's new plant in Tijuana went viral, which contrasts with the housing that surrounds it in one of the poorest neighborhoods, the company in Mexico assured that it is committed to the development of the country, in this case through the generation of more than 250 jobs.

"At Amazon Mexico we are committed to the development of the country and the communities where we live and operate. Since our arrival in the Mexican market, we have generated more than 15 thousand direct and indirect jobs throughout the country, creating job opportunities with competitive salaries in the industry and benefits above the law for all our employees," he said in a statement shared with this media.

"With the upcoming opening of our shipping center in Tijuana, we will generate more than 250 jobs with which we hope to contribute to the promotion of the social welfare of the people who live in the locality and thus continue to benefit thousands of Mexican families," he highlighted.

This statement was shared with Aristegui Noticias after the publication of the video highlighting photos by Omar Martinez of Cuartoscuro of Amazon's new plant in Tijuana.

The building extends over 32 thousand square meters, next to the Vía Rápida, in what will be the ninth distribution center that Amazon opens in Mexico and the second in the north of the country. An average of 21 million dollars were invested in the plant and it will start operations this month.